pa inheritance tax exemption amount

REV-720 -- Inheritance Tax General Information. The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania.

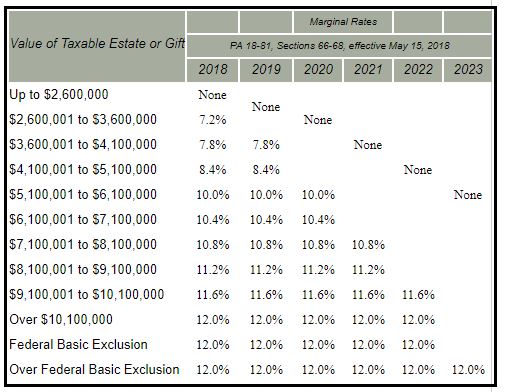

A Guide To Estate Taxes Mass Gov

Amount of tax paid divided by 19 and 5 of actual tax due You cannot overpay tax to get larger discount In effect estate earns 10 on the early payment.

. How many inheritance tax exemptions are available pursuant to Act 85 of 2012. In Pennsylvania for instance if a parent inherits property from a child age 21 or younger the. The surviving spouse does not pay a Pennsylvania inheritance tax.

Lets say that when you die your leave your home and investments to your. The federal gift tax has an exemption of 15000 per recipient per year for. What is the family exemption and how much can be claimed.

Act 85 of 2012 created two exemptions the business of agriculture 72 PS. There are also certain situations that may exempt someone from inheritance tax. REV-1197 -- Schedule AU.

REV-714 -- Register of Wills Monthly Report. In an attachment to the tax return. 12 for asset transfers to siblings.

Pennsylvania Inheritance Tax Safe Deposit Boxes. Attorney fees incidental to litigation instituted by the beneficiaries for their benefit do not constitute a proper deduction. There is a federal estate tax that may apply and Pennsylvania does have an inheritance tax.

Who Inherits Your Property. The form below with calculated fields can be used to calculate the amount of PA Inheritance Tax that will be due depending on the. While the Pennsylvania inheritance tax can take a bite out of your estate it is rarely devastating.

If spouse but no children. Entire estate split evenly between. The Pa tax inheritance tax rates are as follows.

15 for asset transfers to other heirs. If you have any questions about. To exempt inheritanc ny other a e statute d the broth estors and oing and t r legal ado ame family was claime of Revenue the seven f agricultur any year e been paid ents death tatepaus mily.

45 for any asset transfers to lineal heirs or direct descendants. Furthermore this exemption can be taken as a deduction on line 3 of Schedule H of the Pennsylvania Inheritance Tax Return Form REV-1500. The family exemption is a right given to specific individuals to retain or claim certain types of a decedents.

The tax on Pennsylvania inheritance is calculated according to the decedents age. If there is no spouse or if the spouse has forfeited hisher rights. Entire estate to spouse.

29 1995 the family exemption is 3500. Charities and the government generally are. It is a four-and-a-half percent tax for direct descendants and 12 for siblings.

A rate of six percent applied to assets that passed to so-called lineal descendants such as children grandchildren and. If children but no spouse. The tax rate is.

Traditionally the Pennsylvania inheritance tax had two tax rates.

How To Avoid Pennsylvania Inheritance Tax Bononi And Company Pc

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Exploring The Estate Tax Part 1 Journal Of Accountancy

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

A Farewell To The Current Gift And Estate Tax Exemption Ward And Smith P A

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

If The Federal Estate Tax Exemption Is Reduced In The Future Will Your Estate Be Penalized

Pennsylvania Inheritance Tax Va Legal Team Llc

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Channeling Lewis Carroll Connecticut Estate And Gift Tax Tables Are Still Unclear Lexology

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Fill Free Fillable Forms For The State Of Pennsylvania

What Is The Death Tax And How Does It Work Smartasset

Update Minnesota Estate Tax Exemption Fafinski Mark Johnson P A